The Main Principles Of Clark Wealth Partners

How Clark Wealth Partners can Save You Time, Stress, and Money.

Table of Contents6 Simple Techniques For Clark Wealth Partners8 Easy Facts About Clark Wealth Partners DescribedClark Wealth Partners - QuestionsClark Wealth Partners Things To Know Before You Get ThisClark Wealth Partners Things To Know Before You Get ThisMore About Clark Wealth Partners7 Simple Techniques For Clark Wealth PartnersThe smart Trick of Clark Wealth Partners That Nobody is Talking About

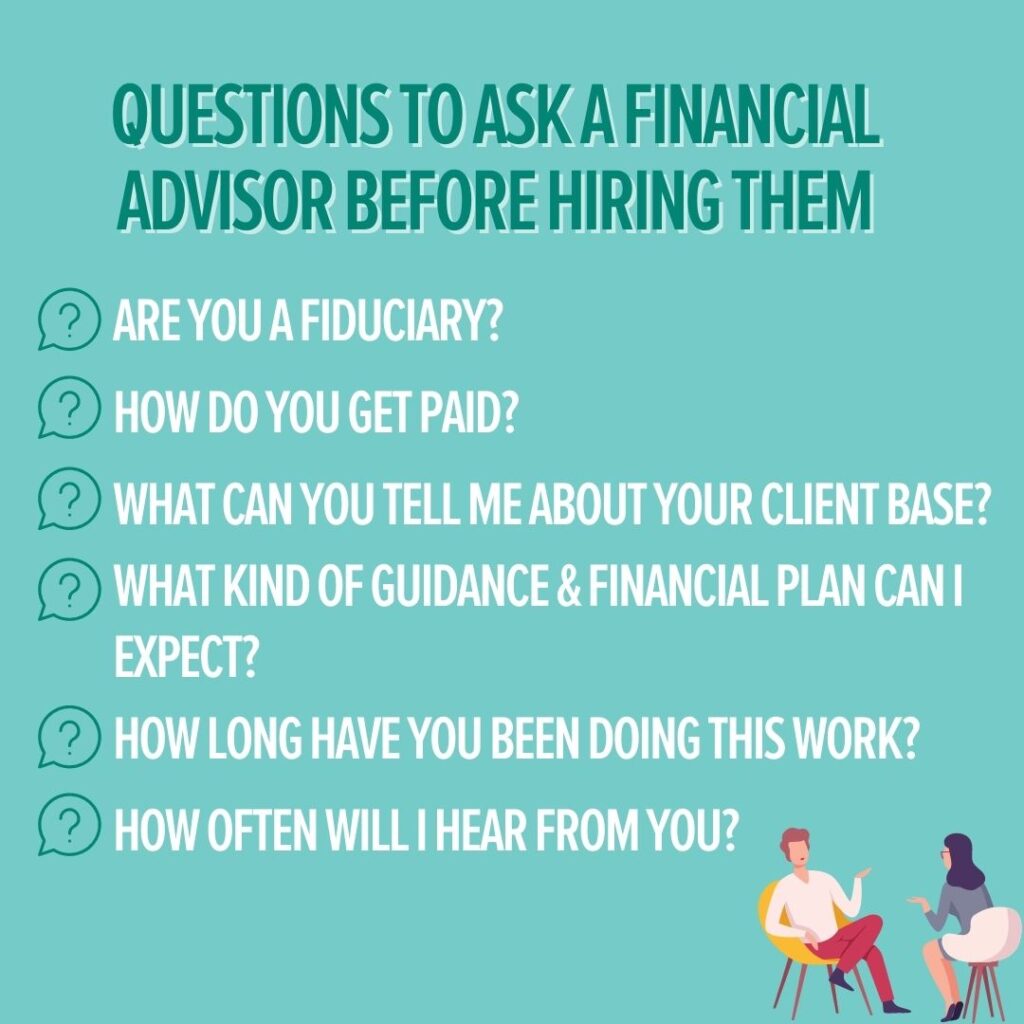

Usual reasons to take into consideration an economic consultant are: If your monetary circumstance has come to be extra complicated, or you lack self-confidence in your money-managing abilities. Conserving or browsing major life occasions like marital relationship, divorce, youngsters, inheritance, or task modification that may significantly affect your monetary circumstance. Browsing the transition from saving for retired life to protecting riches throughout retirement and exactly how to produce a strong retirement revenue plan.New technology has actually caused even more comprehensive automated financial tools, like robo-advisors. It depends on you to explore and establish the ideal fit - https://filesharingtalk.com/members/626317-clrkwlthprtnr. Inevitably, a good financial advisor needs to be as mindful of your financial investments as they are with their very own, staying clear of extreme charges, conserving money on taxes, and being as transparent as feasible concerning your gains and losses

The Ultimate Guide To Clark Wealth Partners

Gaining a compensation on product suggestions doesn't necessarily imply your fee-based consultant antagonizes your finest interests. They may be more likely to recommend products and solutions on which they make a payment, which may or may not be in your ideal passion. A fiduciary is legitimately bound to place their customer's rate of interests.

This typical enables them to make referrals for investments and solutions as long as they fit their customer's objectives, risk tolerance, and monetary situation. On the various other hand, fiduciary advisors are legitimately bound to act in their client's ideal passion rather than their own.

The smart Trick of Clark Wealth Partners That Nobody is Discussing

ExperienceTessa reported on all things spending deep-diving right into intricate financial subjects, losing light on lesser-known investment opportunities, and uncovering methods visitors can function the system to their advantage. As an individual finance specialist in her 20s, Tessa is really conscious of the effects time and unpredictability have on your investment choices.

It was a targeted promotion, and it worked. Find out more Read much less.

Things about Clark Wealth Partners

There's no single course to coming to be one, with some people beginning in banking or insurance, while others begin in audit. A four-year level supplies a solid structure for careers in investments, budgeting, and client services.

:max_bytes(150000):strip_icc()/financialplanner.asp-FINAL-1-55c5c0b665934b9d96cfe8af04fef3a3.png)

The Basic Principles Of Clark Wealth Partners

Usual instances include the FINRA Collection 7 and Collection 65 exams for securities, or a state-issued insurance policy license for offering life or wellness insurance. While credentials might not be lawfully needed for all planning functions, companies and customers often watch them as a standard of professionalism. We look at optional qualifications in the next area.

Most monetary coordinators have 1-3 years of experience and familiarity with financial items, compliance requirements, and straight customer interaction. A strong academic history is vital, but experience shows the capacity to use theory in real-world setups. Some programs incorporate both, allowing you to finish coursework while earning supervised hours through teaching fellowships and practicums.

The Clark Wealth Partners Diaries

Lots of enter the area after operating in financial, bookkeeping, or insurance coverage, and the change requires persistence, networking, and usually innovative qualifications. Early years can bring lengthy hours, stress to develop a customer base, and the demand to constantly prove your know-how. Still, the job supplies solid lasting possibility. Financial planners appreciate the chance to work closely with customers, guide essential life decisions, and often attain flexibility in timetables or self-employment.

They invested less time on the client-facing side of the market. Nearly all financial supervisors hold a bachelor's degree, and lots of have an MBA or comparable graduate degree.

.jpg)

Not known Facts About Clark Wealth Partners

Optional accreditations, such as the CFP, normally require added coursework and testing, which can expand the timeline by a couple of years. According to the Bureau of Labor Statistics, individual economic experts gain a median yearly annual salary of $102,140, with top income earners earning over $239,000.

In various other provinces, there are guidelines that require them to meet particular demands to use the monetary consultant or financial organizer titles. For financial organizers, there are 3 usual designations: Qualified, Personal and Registered Financial Planner.

The 5-Minute Rule for Clark Wealth Partners

Where to locate a financial expert will certainly depend on the type of recommendations you require. These organizations have staff who might help you recognize and buy specific types of investments.